Introduction to GRESB

The Global Real Estate Sustainability Benchmark (GRESB) is an investor-oriented selection organization established in 2009, dedicated to evaluating the environmental, social and governance performance (ESG performance) of the global real estate industry. The evaluation indicators not only provide a complete ESG strategic framework for real estate-related companies, but also cooperate with the industry to provide standardized and verified ESG data for the capital market, so that investors can clearly understand the investment and achievements of various companies in sustainable development.

At present, there are more than 1,000 entities participating in the GRESB. Participants of GRESB include real estate companies, developers, funds and REITs (real estate investment trust funds), and more than 120 investment institutions use their data to monitor investment performance and make decisions in accordance with.

GRESB's rating methodology is consistent across regions, investment vehicles, and property types, and is aligned with international reporting frameworks such as: TCFD (Climate-Related Financial Disclosure), GRI (GRI Sustainability Reporting Principles) and PRI (Responsibility Investment Principles), which will be of great help to real estate-related companies in raising funds in the future and attracting investment from domestic and foreign funds.

Depending on the type of business or investment portfolio of the participating companies, you can choose to participate in the GRESB Real Estate Assessment or the GRESB Infrastructure Assessment:

GREGRESB Real Estate Assessment

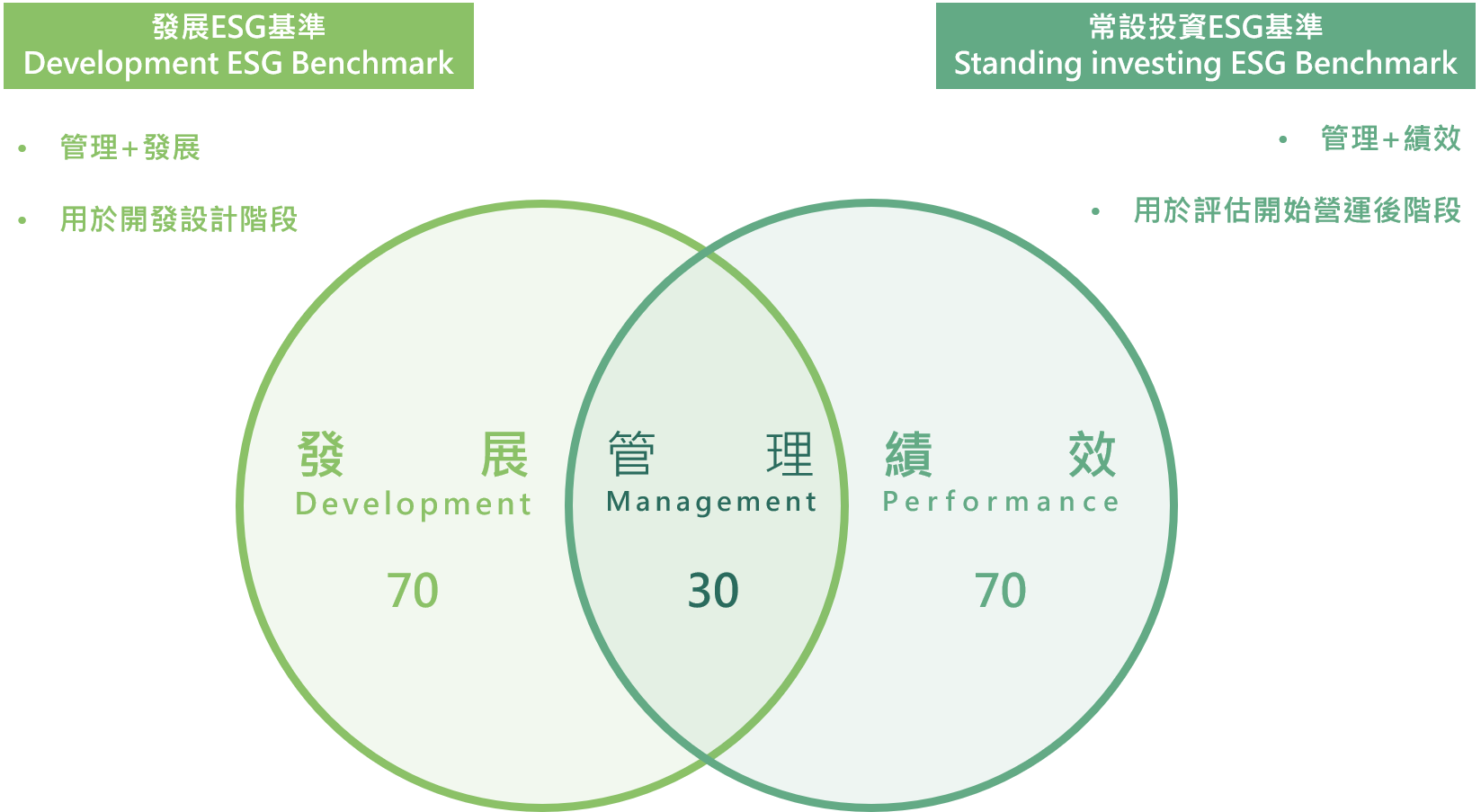

Applicable to listed real estate companies, private real estate funds, developers and investors who directly invest in real estate. According to the asset status of the company, select the type of indicators that the asset portfolio should participate in and the components that should be reported. Therefore, it is divided into two major rating benchmark indicators:

- Development Benchmark (Development Benchmark): Use the Management and Development components to evaluate the development and design phase of assets. Standing Investment Benchmark (Standing Investment Benchmark): Evaluate the post-operation stage of assets with Management and Performance components

Enterprises must not exclude any assets under development or in operation. If there are assets under development and in operation at the same time, they need to form two asset portfolios to participate.

GRESB Infrastructure Assessment

Applicable to operators, fund managers and investors of infrastructure such as data, energy and water resources, network, power generation, renewable energy, social facilities and transportation.

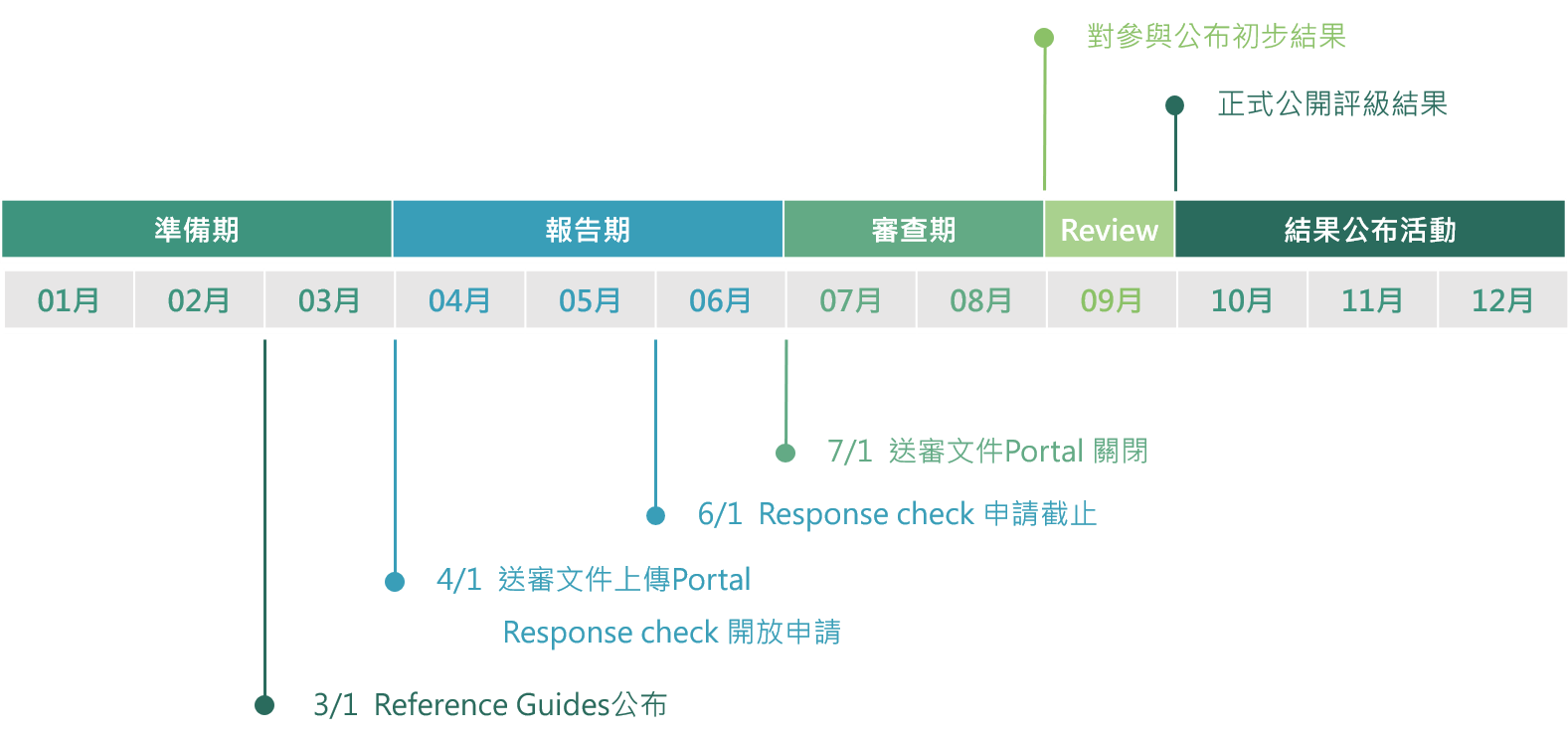

The cycle of GRESB rating is one year, and each year follows the timeline in the table below:

GRESB presents the rating results with star ratings. According to the score performance of all participants in each year, every 20% of the participants will be divided into five equal points. The top 20% of the participants will receive a five-star rating, and the bottom 20% of the participants will receive One star rating. In addition, if the participants meet the special performance of different rating standards, GRESB will also award honors such as Green Star (Green Star), Most Improved Organizations (Most Improved Organizations), and global or regional industry leaders (Sector Leader).

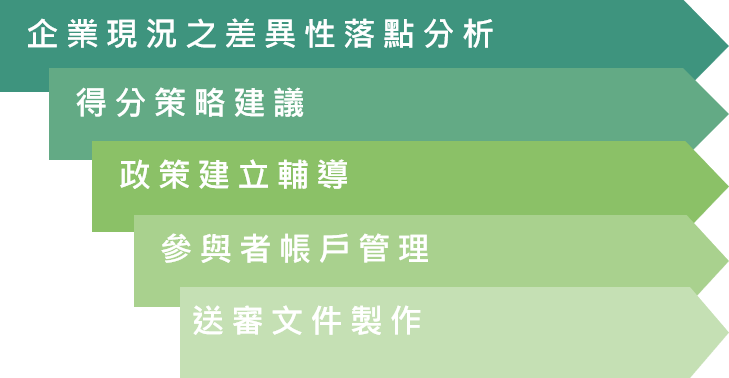

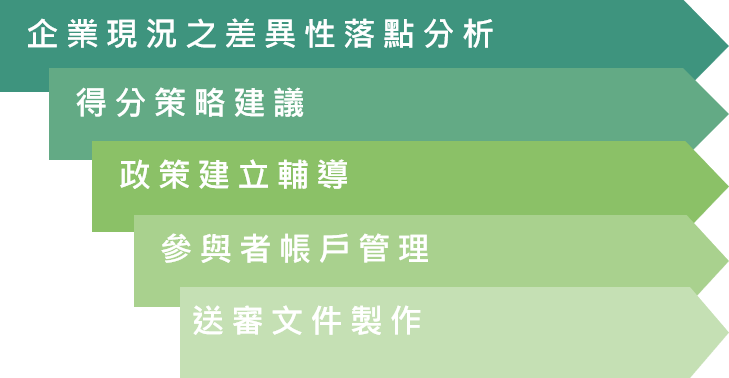

Brief introduction of Yijing service

Yijing GRESB Real Estate Sustainability Consulting Service

Yijing has become an official member of GRESB (GRESB Partner) in May 2022. We can receive e-newsletter exclusively for members, have a special consultation window for members, get important first-hand information, and provide and update to The most immediate GRESB service for Yijing customers serves as a closer communication bridge between customers and GRESB officials.

In 2022, E-Jing assists Dingyue in developing and planning the corporate ESG sustainable development blueprint, and at the same time imports the GRESB rating into it. It is the first company in Taiwan to participate in GRESB, and aims to obtain the highest five-star rating.

In addition to the US LEED green building label and the WELL healthy building standard, through the joint cooperation with the world-renowned real estate rating GRESB, E-land provides more and more diversified projects and values in the sustainable industry, and can comprehensively from strategy to implementation, Create exclusive ESG services for customers.

contact information

ESG Contact Person of Taiwan Headquarters

Yiyi Liu

✉ yiyi.liu@greenjump.com.tw

☎ 02-23110135 #402